Is Friend.Tech a Pyramid Scheme? Uncovering the Similarities

The recent emergence of friend.tech has raised eyebrows and aspirations. Promoted as a SocialFi platform where users can monetize their social capital, friend.tech finds itself at the intersection of social networking and cryptocurrencies.

A product of Web3 developers known in X, formerly Twitter, as oxRacerAlt and Shrimppepe, this platform is creating buzz worldwide. Yet, as the user base grows, so do concerns about its business model. Many argue friend.tech looks strikingly similar to a pyramid scheme.

How Does friend.tech Work?

At the heart of friend.tech is a social token-based system. Users link their X accounts and purchase social tokens, known as shares or keys, representing their stake in another person’s social capital.

A 10% fee levied on every transaction gets split between the protocol and the user whose shares are being traded. The value of these shares fluctuates depending on the user’s popularity and engagement. Therefore offering a tantalizing opportunity to profit from social interactions.

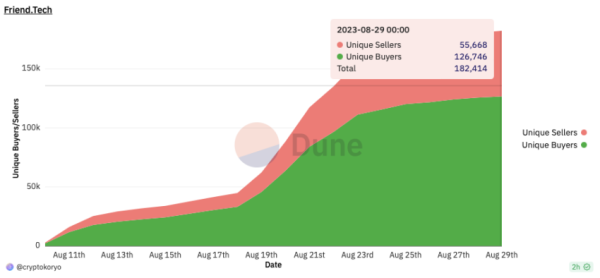

friend.tech Unique Buyers and Sellers. Source: Dune

However, it is worth dissecting the mechanics behind friend.tech to understand why its structure raises concerns about its legitimacy.

“I keep reading that friend tech earns 5% on each transaction. Explain to me how this answer is not 95%? Maybe I do not understand correctly, but when someone sells a ‘key’ they are not buying from another person. It is being minted. A new ‘key.’ 5% to the influencer or creator. FT presumably captures the other 90%, correct?,” Scott Melker said.

As a refresher, a pyramid scheme entices new participants to pay upfront fees to join. Subsequently promising them large returns that are ultimately sourced from the contributions of future participants. Pyramid schemes focus not on selling products or services but recruiting more participants.

Is friend.tech a Pyramid Scheme?

On the surface, friend.tech might seem far apart from a pyramid scheme. Yet, some similarities should not be ignored.

The core of the friend.tech platform is a pyramid-like structure. Here, the value of social tokens or shares increases based on the number of people who invest in a particular user’s social capital. This inherently puts more value on recruitment and expansion of the network rather than tangible, value-added social interaction.

New users must invest in social tokens, and their investment directly increases the value of shares held by earlier users. For this reason, many believe that friend.tech’s architecture could be construed as pyramid-shaped.

friend.tech Active Buyers and Sellers. Source: Dune

Moreover, like pyramid schemes, friend.tech also demands an upfront investment in social tokens for users to participate in its offerings fully. And while the platform does have an actual service — facilitating social interactions — its monetary system focuses primarily on recruitment.

The value of a user’s social token rises not necessarily because users offer insightful information or meaningful interactions but because more people are buying into their social capital.

For instance, technical analyst John Gregory, who goes under the pseudonym Mayne on X, encouraged all his shareholders on friend.tech to sell his shares because he cannot “provide enough value.”

Still, Mayne’s shares sell for roughly $70 each, and users can only read this message after buying the shares.

Another popular analyst under the pseudonym IncomeShares believes it is only a matter of time before friend.tech goes down as more “people realize they cannot provide value for their overpriced shares.”

This underlying dynamic closely mimics the revenue-generating model of a pyramid scheme. Indeed, the emphasis is on increasing the number of participants to boost the returns for those at the top without intrinsic value.

Ponzi or Innovative Business Model?

To be fair, friend.tech operates in a gray area that blends elements of social networking, investment, and perhaps even speculation. However, it skirts dangerously close to the defining characteristics of pyramid schemes, as set forth by regulatory bodies like the Federal Trade Commission (FTC) in the United States.

While Multi-Level Marketing (MLM) firms and pyramid schemes operate on pyramid-shaped structures, the key difference lies in the value generation source. Legitimate MLMs derive revenues primarily from actual goods or services sales, not recruitment.

“Promoters emphasize recruiting new distributors for your sales network as the real way to make money. Walk away. In a legitimate MLM program, you should be able to make money just by selling the product,” the FTC says.

It is worth noting that friend.tech is not alone in blending social interaction with financial investment. In fact, this is a growing trend in the crypto space.

However, in aiming to blend social engagement with crypto investment, friend.tech risks crossing the boundary that separates a genuine business model from a pyramid scheme. This highlights the need for regulatory clarity, particularly in the cryptocurrency industry, where traditional oversight mechanisms often fall short.

Only time and perhaps regulatory scrutiny will determine whether friend.tech is a pyramid scheme in disguise or a revolutionary new platform for monetizing social interaction.