Here’s how much copy-trading Nancy Pelosi’s portfolio yielded in 2023

Nancy Pelosi’s prominence in American politics extends beyond her role as Speaker of the House; she also garners attention from stock market investors due to her potential to influence market dynamics through policy decisions.

Notably, Pelosi has demonstrated her acumen as a successful investor, with her financial endeavors adding an intriguing layer to her profile and piquing the interest of those who track both her political and financial moves.

In the following analysis, we delve into the performance of Nancy Pelosi’s portfolio through copy-trading in the year 2023. Additionally, examining the prominent stocks that the US Representative holds in her portfolio, according to investment app Autopilot’s data retrieved by Finbold on August 11.

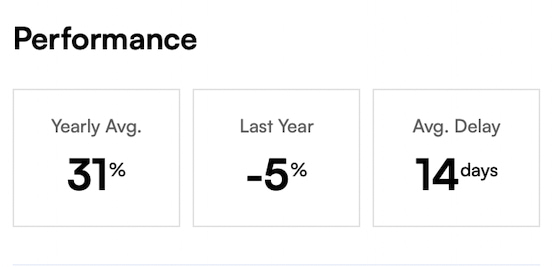

Pelosi’s portfolio returns

Tracking Pelosi’s portfolio yielded an average yearly return of 31%, Autopilot data showed. On the other hand, the portfolio’s value declined by 5% in the last year. The figure represents notably more than Warren Buffett’s 2023 portfolio returns, although still less than legendary investor Michael Burry.

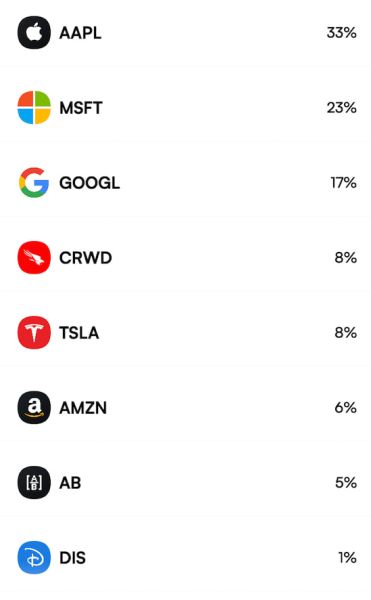

Predictably, more than half of Pelosi’s portfolio is captured by the world’s most successful tech stocks.

To be more specific, the US representative allocated 33% of her portfolio to Apple (NASDAQ: AAPL), the largest company on the globe.

Further, other significant holdings include Microsoft (NASDAQ: MSFT) at 23%, Alphabet (NASDAQ: GOOGL) at 17%, Crowdstrike (NASDAQ: CRWD) at 8%, Tesla (NASDAQ: TSLA) at 8%, and Amazon (NASDAQ: AMZN) at 6%.

Pelosi also invested 5% of her portfolio into investment management firm AllianceBernstein (NYSE: AB) and 1% into Disney (NYSE: DIS).

Individual stock performance

The biggest position in the so-called ‘Pelosi tracker’ portfolio, AAPL, delivered a remarkable rebound this year after a challenging 2022. The tech giant’s shares gained more than 42% since Jan. 1, soaring from $125 to just below $178.

At the same time, MSFT saw a similar surge since the start of the year, climbing around 35%, while GOOGL surged over 45% over that period, capitalizing on the ongoing artificial intelligence (AI) craze.

However, the key driver of Pelosi’s portfolio gains is the electric vehicle (EV) behemoth Tesla, whose stock value skyrocketed by a whopping 127% this year, from $108 to $254 per share.

Amazon also outperformed its tech rivals, jumping more than 61% year-to-date.

Pelosi’s smallest holdings, DIS and AB are also the ones with the most underwhelming performance, with the former climbing only 3% while the latter lost 15% since the start of the year.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.