Why Avalanche (AVAX) Can’t Recover?

Avalanche (AVAX) dropped below the $10 support level a few hours before the time of writing this article. A report from last week highlighted a strong downward trend on the 1-day chart, and this outlook has not changed much since then. Price movements on lower timeframes indicated an increase in selling pressure. The psychological $10 support, which was also technically significant last year, has been broken.

How Much is the AVAX/USDT Price?

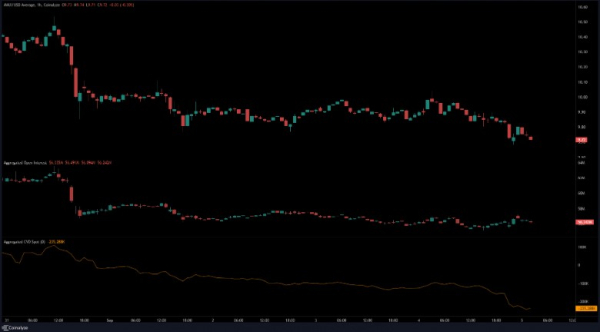

It didn’t seem like a good time to be an Avalanche bull. The market structure on the daily and 4-hour timeframes was bearish. The 4-hour chart of the cryptocurrency showed an uptrend block at the $10 level, but it turned into a downward movement as it reversed in the last few hours. The red box could have indicated a retest and rejection of the $9.77 to $10.06 levels, which could have provided an ideal bearish opportunity.

A move above the $10.2 level could invalidate the proposed bearish idea. A move to $8.59 in the lower region remains a likely target. These levels represented the 23.6 Fibonacci extension level and were drawn based on a rally from $10 to $15.97 in June and July. The RSI was below the neutral 50 level and was in line with the bearish market structure in terms of momentum. OBV saw a spike on August 29, but retraced those gains, indicating that bulls were unable to sustain the pressure.

Avax Coin Review

Data from MobChart showed that there were buy orders of nearly $1 million between $9.6 and $9.48. This suggests that AVAX could see a bounce at these prices or just above them and could gather liquidity upward before another drop. Nevertheless, the exhaustion of this buyer wall may take some time.

On September 4, Open Interest slightly increased as the price dropped from $10 to $9.7. This indicated a short-term bearish trend and the presence of short-selling. Spot CVD also experienced a clear decline in the last few hours.

Therefore, based on the evidence, it is not unreasonable to suggest that Avalanche prices could further decline in the next week or two. Investors may not need to FOMO in to take positions, but they may prefer to wait for movements towards areas of interest like the $10 breakout block to evaluate trading opportunities.

Disclaimer: This article does not contain any investment advice. Investors should be aware that cryptocurrencies carry risks due to their high volatility and should conduct their own research before making any transactions.

Source