Solana Faces Bearish Consolidation As On-Chain Activities Decline! Will Bulls Lose Control Of SOL Price?

Recently, Solana (SOL) has found itself in the spotlight, although not in the way investors might have desired. This altcoin, renowned for its rapid transaction speeds and cost-effectiveness, is currently struggling with a period of bearish consolidation, seen by a noticeable drop in on-chain activity. Amidst a broader bearish correction in the cryptocurrency market, with Bitcoin’s price hovering below the $43,000 mark, the altcoin sector is feeling the pressure. Consequently, SOL is preparing for a significant decline, marked by massive daily liquidations.

SOL Price Continues To Face Massive Liquidations

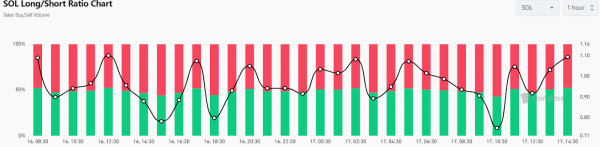

Currently, there is an intense battle between buyers and sellers in the market, as they aim to validate a clear trend for SOL price, which is hovering within a channel. This intense competition has resulted in significant liquidations from both sides amidst the fluctuations in the altcoin market. Recent data from Coinglass reveals that Solana has experienced total liquidations nearing $5 million. Of this, buyers have faced liquidations of around $2.1 million, while sellers have seen their positions liquidated to the tune of approximately $3 million.

In the wake of last week’s endorsement of spot Bitcoin ETFs, Bitcoin’s price is now caught in a tight range. This pattern reflects a rising sentiment of uncertainty and caution among investors, triggering a challenging trend for the altcoin market and SOL price.

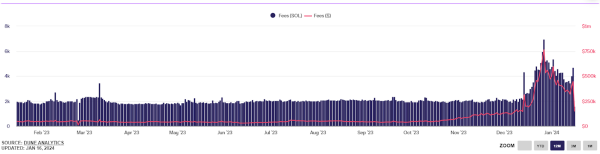

Recently, there has been a notable decrease in Solana’s transaction fees, marking a consistent downward trend that began around December 27. The data shows a significant drop in fees, plummeting to a low of $148K from a high of $763K. This reduction in fees follows a decrease in the daily active addresses on the Solana network, which have fallen by over 50% in a week, indicating a lower level of network activity.

The fees for transacting on the Solana network are determined by the network itself, based on current congestion levels and past transaction throughput. Approximately half of the fee charged for each transaction is permanently removed from circulation (burned), with the remaining portion compensating the validators who process the transactions.

While Solana is known for having lower transaction fees compared to Ethereum, an increase in these fees is indicative of heightened activity on the Solana network. This uptick suggests that the network is experiencing a surge in usage and transaction volumes.

On a positive note, lower fees could enhance Solana’s appeal to new users and developers. If this leads to increased adoption and network activity in the long run, it could positively impact SOL’s price.

What’s Next For SOL Price?

Solana experienced a rebound from its downtrend line recently, suggesting strong buying pressure recently. However, the SOL price is facing selling pressure in breaking above its consolidated channel. As of writing, SOL price trades at $98.5, surging over 0.8% from yesterday’s rate.

The 20-day Exponential Moving Average (EMA) is currently stable at around $97, and the Relative Strength Index (RSI) is hovering around the midpoint at level 54. This indicates an equilibrium in supply and demand. Should the price fall below the moving averages, the SOL/USDT pair might test the support line at $76.

On the other hand, a climb above the moving averages would indicate that buyers were purchasing during the dip. This could lead the pair to potentially break the channel’s resistance line, and head toward $125. To signify a continuation of the upward trend, buyers will need to overcome this key resistance level.

At the time of this writing, there’s a noticeable shift towards bullish sentiment among buyers, as indicated by the long/short ratio exceeding 1. This ratio, which compares the volume of buyers to that of sellers, demonstrates an increasing dominance of buying activity when it rises above 1. Presently, the ratio is at 1.0938, indicating that more than 52% of all positions are anticipating a rise in the price of Solana.