Meme coins unwind, SOL loses 9% in 24 hours

In the final days of 2023, Solana ecosystem traders appear to be collecting their profits, pushing the native token and other assets into the red.

Solana erased gains Thursday morning, dipping close to 10% in 24 hours to just under $100 after nearly hitting $125 earlier in the week. The ecosystem’s native token (SOL) still remains up around 75% since late November and 776% since the start of 2023.

Solana meme coin BONK, which gained more than 26,000% in November, is now down 58% since its highs earlier this month.

BONK lost 18% in 24 hours Thursday, putting the token down more than 30% over the past week. The coin is still up close to 200% in the past month and 11,411% over the past year.

BONK, created in the aftermath of FTX founder Sam Bankman-Fried’s downfall in 2022, came onto the scene when Solana sentiment was at a low. Since then, however, several Solana projects have integrated BONK for payments, helping increase adoption and, in turn, its price.

“The rally also correlates with renewed enthusiasm around Solana, which has remained resilient despite immense headwinds triggered by FTX’s collapse. SOL is one of the year’s best performers and is far outpacing ETH since early Fall, with the SOL/ETH price ratio reversing for the first time since 2021,” analysts from crypto research firm Kaiko said earlier this month.

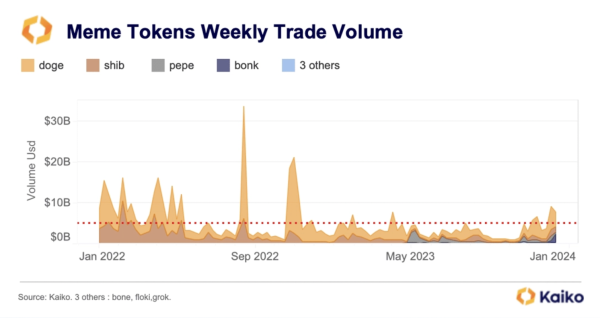

Meme coins on the whole are nowhere near the all time high trading volumes recorded in 2022 though, but top tokens still remain above the two-year average.

Despite the dip, 2023 on the whole has been an eventful year for the Solana blockchain. 85% of protocols on the chain are now open source, as opposed to 30% in 2021. Circle also debuted its Euro stablecoin (EURC) on Solana in December. The stablecoin issuer selected Solana for its “ulta-fast, near zero cost network,” Circle said on X at time of launch.

Thursday’s selloff follows an explosive few months for altcoins, which saw tokens like Polygon (MATIC) and Chainlink (LINK) gain 78% and 105%, respectively, since October.

In the week ending Dec. 10, Solana investment products saw inflows of $3 million, according to data from CoinShares Research. SOL and Avalanche, which clocked $2 million in inflows over the same period, are “firm favorites in the altcoin space,” James Butterfill, head of research at CoinShares, said.