Machine learning algorithm sets Dogecoin price for January 31, 2024

The assessment of Dogecoin’s (DOGE) value remains a key focus, with investors monitoring whether the meme coin can reach the highs seen in 2021.

Notably, as the market anticipates a potential bull run, particularly with the possible approval of a spot Bitcoin exchange-traded fund (ETF) in the US, it is intriguing whether Dogecoin can capitalize on this momentum to achieve new highs.

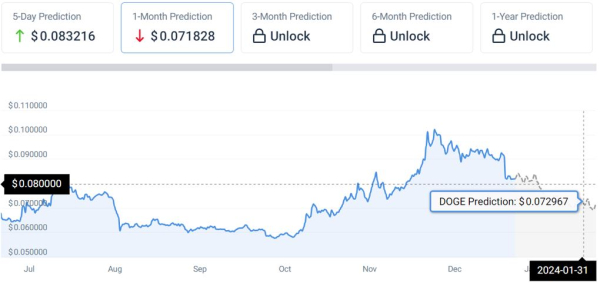

To begin 2024, Dogecoin has experienced a bearish start, erasing a significant portion of the gains it had accumulated in early December. When analyzing the potential trajectory of DOGE prices, Finbold sought insights from artificial intelligence (AI), which forecasts a continuation of bearish trends throughout January.

In particular, advanced AI price prediction algorithms from the crypto market analytics and prediction platform CoinCodex project Dogecoin’s price on January 31, 2024, to be $0.072. This valuation reflects a decline of approximately 10% from the coin’s price at the time of this publication.

DOGE’s bullish catalysts

It’s essential to highlight that the trajectory of Dogeocoin’s price is predominantly tied to the overall market direction, currently lacking specific bullish triggers. Notably, past bullish movements in DOGE were often influenced by events like mentions from Tesla (NASDAQ: TSLA) CEO Elon Musk, a significant supporter of the meme coin.

In connection to Musk, a noteworthy catalyst is the scheduled rollout of payment services by X (formerly Twitter) in 2024, and Dogecoin is poised to benefit from this development.

Meanwhile, DOGE continues to experience increased on-chain activity, particularly involving large transactions by whales. On January 1, a notable transfer of 59.9 million DOGE (approximately $5 million) occurred from an unidentified wallet to Coinbase, reflecting a trend in the Dogecoin ecosystem with a recent surge in high-value DOGE transfers.

Elsewhere, a review of Dogecoin’s technical analysis is bearish. A summary of the one-day gauges retrieved from TradingView recommends the ‘sell’ sentiments at 13 while moving averages are for ‘strong sell’ at 11. Oscillators are ‘neutral’ at 8.

Overall, Dogecoin’s ability to rally will be heavily reliant on how the general market moves.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.