Litecoin’s (LTC) Price Stalls at $70 Amidst All-Time High Mining Difficulty

The Litecoin (LTC) price bounced at a long-term horizontal and diagonal support area last week.

The price has not begun a significant increase yet, though there are positive signs in lower time frames.

Litecoin Attempts to Bounce at Support

On the weekly timeframe, LTC’s price action shows a decline from its peak at $115 in July 2023. The drop led to a low of $56 in August. Following a brief rebound and subsequent decline, the Litecoin price created a higher low (green icon).

This bounce in Litecoin’s price confirmed a long-standing ascending support trend line. The trend line has existed for nearly 600 days and coincides with a horizontal area that has served as support and resistance.

LTC/USDT Weekly Chart. Source: TradingView

Traders commonly employ the Relative Strength Index (RSI) as a momentum indicator to evaluate whether a market is in an overbought or oversold condition, guiding decisions to accumulate or sell an asset.

When the RSI surpasses 50, and the trend is upward, bulls retain an advantage; conversely, if the reading falls below 50, the opposite holds true. Currently, the weekly RSI stands at 50, indicating an undetermined trend.

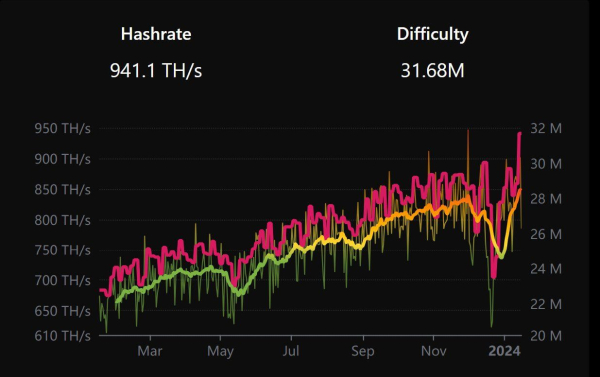

Litecoin Mining Difficulty Reaches All-Time High

Today, the Litecoin team announced that the mining difficulty reached a new all-time high. This is a sign of network growth and increased maturity.

Litecoin Mining Difficulty Chart Source: X

Additionally, the team announced that 18,000,000 ordinals have already been inscribed on the Litecoin network.

LTC Price Prediction: Has Price Started a Reversal?

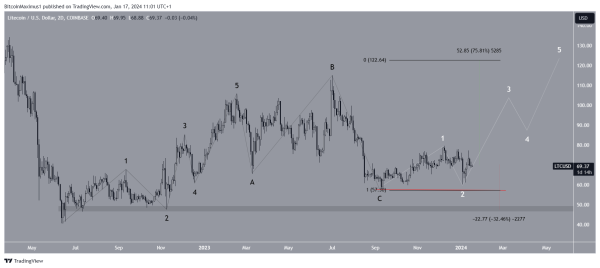

Like the analysis of the weekly timeframe, the 2-day chart does not provide a clear confirmation of the trend’s direction. Still, the wave count leans towards a bullish scenario.

Elliott Wave theory, which involves studying recurring long-term price patterns and investor psychology, is utilized to discern the trajectory of a trend. The prevailing wave count implies completing a five-wave upward movement and an A-B-C corrective structure initiated in June 2022.

According to this scenario, Litecoin began another upward movement (white) in September 2023. LTC is anticipated to surge by 75% if these upward movements have the same length, reaching the next resistance level at $122.

LTC/USDT 2-Day Chart. Source: TradingView

Despite this bullish prediction for LTC’s price, it’s crucial to note that a dip below the September 2023 low of $57.30 (red) would negate the bullish count. In such a scenario, Litecoin might experience a 30% decline, finding support at $48.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.