Celestia Crypto: Can TIA Crypto Break Out of the Wedge Pattern?

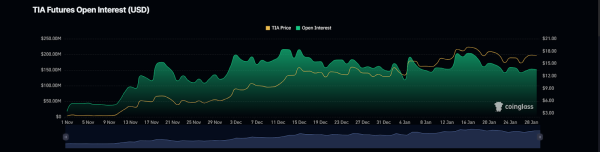

- 1 The TIA derivative data analysis highlights that the open interest is $160.51 Million.

- 2 Its market capitalization is $2,787,864,464 and its trading volume is $160,419,577.

- 3 The volume chart indicates a significant rise in the gain of interest and activity for TIA.

TIA plummeted by 0.29% in market capitalization and while its trading volume increased by 16.15% in the last 24 hours as per CoinMarketCap, a crypto data analysis website. Its market capitalization is $2,787,864,464 while its trading volume is $160,419,577. There are 160,550,377 TIA assets in circulation.

Source: By Coinmarketcap.com

The TIA derivative data analysis highlights that the open interest is $160.51 Million. As per Coinglass, another crypto analysis website, it rose by 2.31% in the previous session.

Source: By Coinglass.com

The long versus short ratio for 24 hours is 9608. The short liquidation is $235.95K versus $583.18K for the long liquidation.

Source: By Coinglass.com

Looking at the chart, it can be seen that the asset volume was increasing from the $40 Million mark. The volume chart indicates a significant rise in the interest and activity for TIA.

Source: By Coinglass.com

Will TIA Crypto Price Rise and Reach the Upper Boundary of the Wedge?

The Celestia crypto asset is showing bullish traits and can achieve further growth. The TIA crypto has demonstrated good performance in the past week, month, and three months, by 2.93%, 39.93%, and 566.12% respectively, indicating a reliable upward trend.

Source: by TradingView

The TIA crypto is experiencing a surge of 2.37% in the last 24 hours, trading at $17.404.

However, the TIA crypto has displayed a sign of revival as the price bounced back from a critical level of around $15 on the charts.The TIA crypto is poised for a spectacular rally, as it is poised to smash the obstacles and roar towards new heights from the current level.

The Celestia crypto asset is also showing bullish strength and rising potential as it stays above the major 20 and 50-day EMAs.

Furthermore, the TIA crypto asset is in a strong uptrend and the MACD histogram is narrowing, which points to bullish crossover possibilities in the upcoming sessions.

The RSI shows no signs of overbought conditions and it is above the 50 level and has recently crossed the 14-SMA line from below, suggesting that the asset has more room to grow.

Therefore, if the demand for the Celestia remains high, the asset price could bounce back from the current level. In such a scenario, the next goal for the price could be to reach $22.

However, if the crypto price fails to stay above the $15 level, it could decline further and could even break out of the wedge pattern.

Source: by TradingView

Summary

The TIA crypto is poised for a spectacular rally, as it harnesses strength to smash the obstacles and roar towards new heights from the current level.

Furthermore, the Celestia crypto asset is also showing bullish strength and rising potential as it stays above the major 20 and 50-day EMAs. The MACD histogram is narrowing and the RSI is above the 50 level.

Therefore, if the demand for the Celestia cryptocurrency remains high, the asset price could bounce back from the current level. Then, the next goal for the price could be to reach $22.

Technical Levels

Support Levels: $15

Resistance Levels: $22

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Amanda Shinoy

Amanda Shinoy is one of the few women in the space invested knee-deep in crypto. An advocate for increasing the presence of women in crypto, she is known for her accurate technical analysis and price prediction of cryptocurrencies. Readers are often waiting for her opinion about the next rally. She is a finance expert with an MBA in finance. Quitting a corporate job at a leading financial institution, she now engages herself full-time into financial education for the general public.